The demand for batteries in the Europe market is booming. The continent’s aggressive pursuit of clean energy and sustainable transportation, combined with growing demands for electric vehicles, renewable energy storage solutions, and the shift towards carbon-neutral policies, have rapidly led European countries to establish local battery cell manufacturing plants. Companies such as Tesla and Northvolt, among others, have become Germany’s central hub for battery production.

This rapid growth has underlined Europe’s commitment to leading the battery world. Nonetheless, the present status quo, challenges, and opportunities for lithium battery cell manufacturers and suppliers in Europe should be well known.

In this article, we will go deep into the current status of battery cell manufacturing in Europe, the difficulties to overcome, and further opportunities for European companies to develop in the following years.

(Copyright photo from: https://www.freepik.com/free-photo/3d-recycle-batteries_13328732.htm#fromView=search&page=1&position=52&uuid=a5bbf66e-6642-4908-90f9-802599cc8461)

Current Status of Battery Component Preparation in Europe

Europe has done very well in developing capabilities to manufacture lithium battery cells. Still, almost all the production remains reliant on critical components such as cathode and anode materials, separators, electrolytes, and cell packaging. Let’s dive deeper into the key elements:

Cathodes and Anodes Materials[1]

Cathode and anode materials form the backbone of lithium battery cells. European manufacturers heavily rely on imported raw materials, mainly acquired from China. Lithium, cobalt, nickel, and graphite are important for high-performance cathodes and anodes.

Germany is on the front lines of Europe’s battery race; it has sizeable investments in R&D capability to localize some of these material productions, but for now, Europe still relies on global supply chains to meet its cathode and anode material requirements.

Separators

Separators, an important one crucial for preventing shorts between cathode and anode, are the other important ones. Though European companies have improved the separator technology, there is much more emphasis on outsourcing around 90-95% to other countries, like China, South Korea, etc.

Electrolytes

The electrically charged ions and molecules, referred to as electrolytes, play an important role in the passage of lithium ions between the electrodes. A challenge for Europe lies in the mass demands on battery consumption but less electrolyte production. It only counts 7% to support its own battery manufacturing.

Packaging of the Cell

Packaging plays a critical role in the stability and shelf life of lithium battery cells. Cell-packaging capabilities are being strengthened in Europe, while the driving force continues to be Germany. Advanced automated lines will be established as the manufacturing of battery cells will have the ability to scale up very quickly in order to support demand.

Challenges for Limited Lithium Battery Cells Development in Europe

From the statement above, you can understand several challenges facing this industry in developing the lithium battery cell on a full scale in Europe.

Absence of Production of Core Elements

As mentioned above, the continent continues to import critical aspects such as lithium, cobalt, and nickel from other parts of the world that are the primary needs of battery cells. An indication is that the elements are not in abundant supply in Europe, hence making the continent easily exposed to global supply chain fluctuations.

Asian Companies Expand Their Battery Manufacturers in Europe

Asia, particularly China and South Korea, is taking the lead worldwide. CATL, for example, has raised its investments in Europe and established local plants directly competing with domestic suppliers. No wonder that incumbent Asian battery companies pose a threat to new entrants in Europe.

Lengthy Timelines Required for Testing and Validation

Tests, validations, and other procedures may consume weeks, even months, before the lithium battery cell is produced. Manufacturing of a battery cell needs extensive testing and validation to be both safe and perform well, however, this imposes long time frames in bringing the product to market, which slows down innovation and makes Europe leave its competitors in Asia behind.

Opportunities for Lithium Battery Cells in Europe

Despite all these drawbacks, there are enormous opportunities for lithium battery cell makers to seize the trend and opportunities quickly in Europe.

Import Locally

One strategic area for localization for European producers is through the extraction of the strategic raw materials used to produce strategic components, meaning fewer imports. Exciting initiatives in the domestic mine of lithium in Germany have driven such initiatives, and the signing of partnership agreements between Germany and neighboring countries have been established for the provision of raw materials. Manufacturers would incur less cost in logistically managing supply chains because of fewer failures in supply chains. Energy independence is attainable among states on the continent.

Policy Support: GDIP

Implementing policies, such as those provided by the European Union, support the development of lithium battery cell production. The European Green Deal Investment Plan (GDIP) has invested billions in funding sustainable energy projects, covering within its scope even battery manufacturing. Such policy support makes an environment conducive to manufacturers and suppliers to increase their operation levels and innovatively create new technologies.

Turnkey Battery Cell Manufacturing Lines

In the backdrop of increasing demand for battery cell manufacturing, turnkey solutions have emerged as the need of the hour. Totally integrated companies like SZJ Automation offer Pouch Cell Turnkey Solutions, a way to manufacture the raw material into a finished product. Such sophisticated technologies would help the manufacturers in Europe reduce setup times and operational costs substantially, thus keeping them on par with global players.

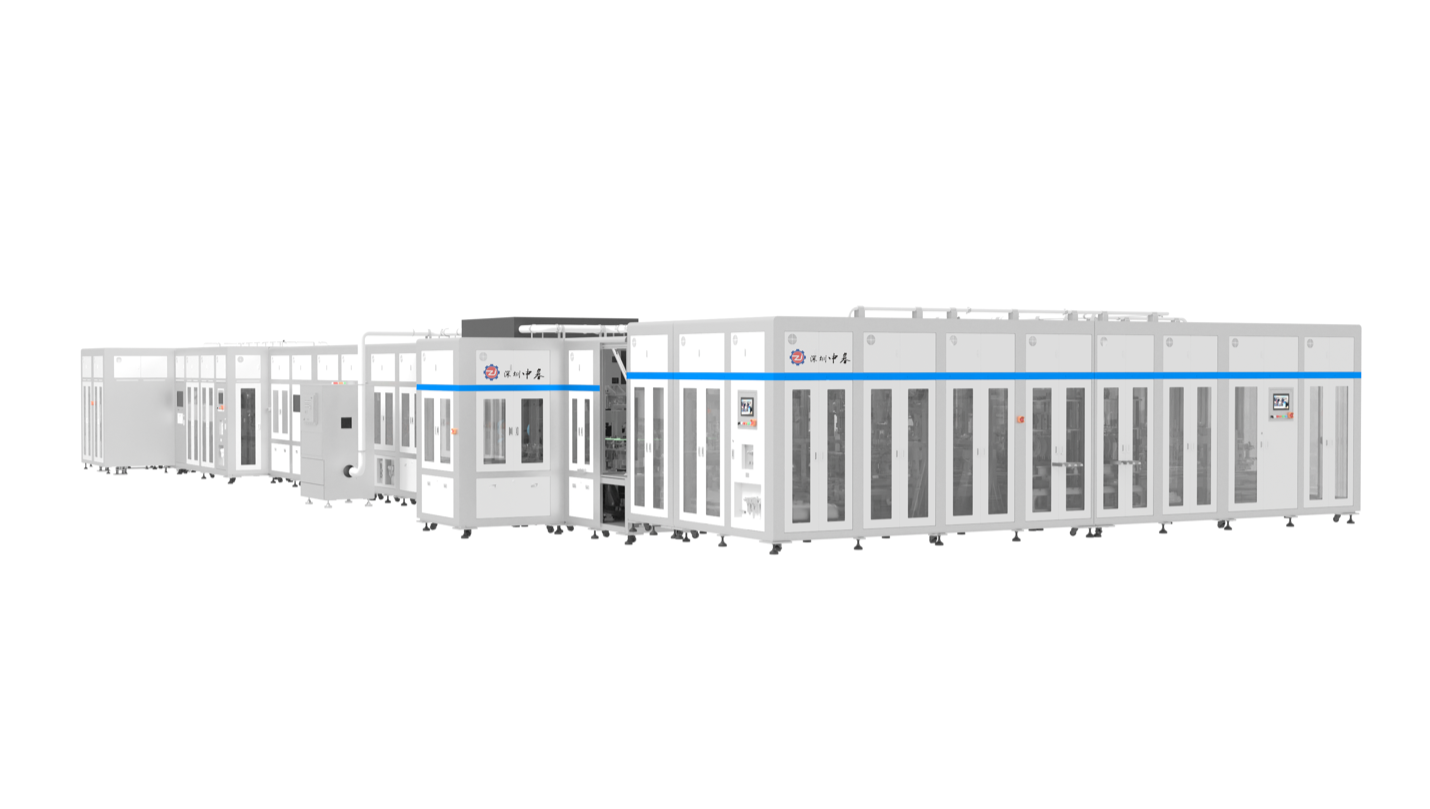

SZJ Automation Pouch Cell Turnkey Solution

As the business of battery cell manufacturing in Europe continues to rise, efficient and cost-effective production technologies for manufacturers have become a necessity. Our SZJ Automation’s Pouch Cell Turnkey Solution includes an integrated system with material preparation, cell assembly, and final packaging.

Our lithium battery cell manufacturing line is highly suitable for the European market because it combines high efficiency with exceptional quality control, meeting the stringent standards and demands of the region. The solution achieves a production rate of 10-24 parts per minute (PPM), which allows manufacturers to meet the growing demand for lithium pouch cells driven by Europe’s push for electric vehicles and renewable energy storage.

Besides, with a 99% product qualification rate, the solution ensures that nearly all produced cells meet quality and safety standards, which is vital for Europe, where regulations are rigorous and consumers have high expectations for product reliability and performance. Additionally, the equipment utility rate of 98% means the manufacturing process experiences minimal downtime, leading to increased productivity and cost-effectiveness.

What makes the solution unique lies in a very high level of automation; it results in less human error and quality consistency. The feature of SZJ Automation’s turnkey solutions can be accessed in Europe, where a fast and precise setup has been largely in demand as one of the biggest challenges. As a result, manufacturers face prolonged testing and validation in such a competitive market. Options for customization further make the system appropriate for German manufacturers who should expand their production without jeopardizing quality or safety.

Conclusion

The European lithium battery cell industry stands at a crossroads. Whereas the opportunity is humongous, from electric vehicles to renewable energy, there are equally considerable challenges to be tackled: from reliance on imported input material to the competition of production from well-established Asian players and an inordinately long time needed to start producing.

However, European players can position themselves firmly in the arena as global leaders in the market of batteries by making maximum use of resources at home. And they are also embracing favorable policy stimuli. More importantly, they have the choice to capitalize on cutting-edge manufacturing technology, such as our SZJ Automation’s Pouch Cell Turnkey Solution. Experience and expertise make SZJ Automation quite capable of helping to meet the growing demand of European manufacturers with quality and efficiency. Or contact us if you have more questions!

Reference

- Available at: https://www.automotivelogistics.media/battery-supply-chain/charging-up-in-europe/45348.article

- Available at: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-battery-cell-component-opportunity-in-europe-and-north-america#/